|

|

|

|

|

|

|

|

Investing for Retirement Income

Ray Johnson, CFP

June 2006

The stock and bond markets continue to be a challenging place for retirees to trust their retirement savings. I am often asked how to invest in today's markets. Most of my clients are either retired or soon will be. Their dilemma is that they require both current income from their investments to supplement their current living needs, while at the same time they need future growth on their investments to ensure that they will have enough retirement savings to meet their living needs for the remainder of their lives. There are no "do overs" so they need to get it right the first time.

Financial planners are coming to appreciate the difference between accumulating and distributing retirement savings. Statistical studies show that market volatility is your friend during the accumulation years and your worst enemy during the distribution years. Most of us have heard about dollar cost averaging, where a periodic investment into a stock portfolio buys more shares in down markets and leverages the gain when the stocks return to their value in the future. Accumulating shares at lower prices is the key to building long term wealth.

You get a different outcome when looking at market volatility during retirement as you are taking periodic distributions from your investment portfolio. When you sell shares of an investment to allow periodic withdrawals from your portfolio, you are forced to liquidate more shares in down markets to provide the same amount of funds required to meet your living needs. The sale of these shares removes them from your portfolio, so when the market comes back in value, these shares are now consumed and not available to benefit from the return of share value. This condition is known as Dollar Cost Erosion.

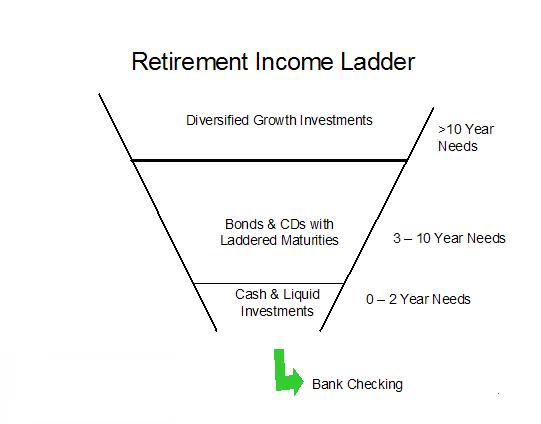

My approach to this dilemma is to construct a retirement timeline to determine how and when a retired family needs access to their retirement capital. Once this is known, I build a "Retirement Income Ladder" to provide both the short and intermediate income needed, while at the same time providing for long-term growth. The overall key to this approach is to remove as much risk as possible from your retirement income needs for the next ten years and provide long-term growth using a diversified portfolio of low-cost growth investments for your retirement income needs projected out for ten years or more. The following paragraph and graph illustrate this method:

Recommended Strategy -- Build a Retirement Income Ladder

Consider money market funds for short term (0-2 years) needs, short to intermediate-term Treasury bonds and CDs for intermediate (3-7 year) needs, and diversified stocks and stock mutual funds for long term (more than 7 - 10 years) needs.

The cash & liquid investment reservior is replenished from CD and bond interest and maturing CDs and bonds as time passes. The laddered CD/bond portion of the income ladder are replaced at the longer maturity end by selectively liquidating stocks and stock mutual funds. This helps assure that stocks can be liquidated casually to capture gains and not required to be sold quickly during a time of market stress.

Favor individual growth stocks and exchange-traded funds (ETFs) in your taxable investment accounts and mutual funds in your tax deferred plans to capture the tax preference available in these investments. Keep investment expenses as low as possible and your choices flexble. Shy away from investments with surrender charges and front-end sales charges.

Typically, a retired family's supplemental income needs are electronically direct-deposited by transferring funds from the plan's money market account to their local bank or credit union checking account on the first of each month. This replaces the direct deposit of their paycheck received during their working years.

|

|

|

|

|

|

|

|

|